As artists and record labels clamor over YouTube payouts, some iare skeptical that Google's subscription service can change the equation.

YouTube Red Originals

Since the freewheeling, Napster days of digital music, artists and labels have been forced to accept some very hard realities about their industry. From peer-to-peer piracy to the life-preserver Apple tossed out to record companies in the form of iTunes, to the rise and dominance of streaming services, upheaval has been a mainstay of music's relationship with computers. But the Silicon Valley side of the equation has had to swallow a difficult truth as well, and one that's inimical to a tech industry built on advertising: In music—as with other kinds of creative and professional pursuits online—paying subscribers are a far more sustainable source of revenue than free users who look at ads (which, in any case, they are increasingly trying to block).

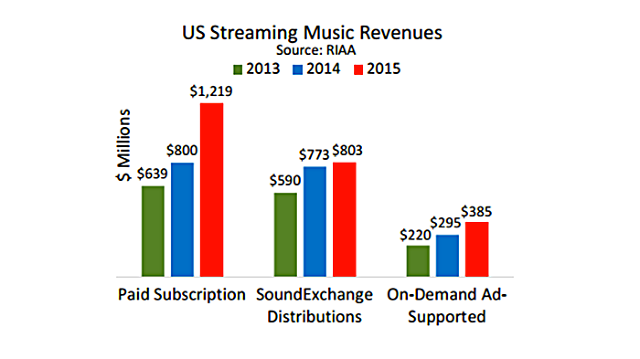

Last year, according to the Recording Industry Association of America, subscription streaming services like Apple Music and Spotify’s paid tier generated $1.2 billion, amounting to about half of the revenue for the entire U.S. streaming industry. Meanwhile, ad-supported streaming—which includes Spotify’s paid tier along with YouTube’s massive video platform—only generated $385 million for the U.S. market in 2015.That revenue gap becomes even more dramatic when taking into account the RIAA’s estimate that only 10.8 million Americans paid for streaming subscriptions last year on average, while the number of ad-supported

streaming customers includes

YouTube’s 200 million monthly users in the U.S., plus millions of Americans who listen to Spotify’s free ad-supported option. Put another way, the average listener of an ad-supported streaming service was worth less than $2 to the music industry in 2015, while the average paid subscriber was worth $120. (The remaining $803 million in streaming revenue, labeled under "SoundExchange Distributions," came from Internet radio services like Pandora.)

streaming customers includes

YouTube’s 200 million monthly users in the U.S., plus millions of Americans who listen to Spotify’s free ad-supported option. Put another way, the average listener of an ad-supported streaming service was worth less than $2 to the music industry in 2015, while the average paid subscriber was worth $120. (The remaining $803 million in streaming revenue, labeled under "SoundExchange Distributions," came from Internet radio services like Pandora.)

It’s little wonder then that the music

industry has soured on ad-supported

streaming. And with superstars like Taylor Swift and U2 serving as the industry’s public face, labels and artists have launched a number of campaigns this year that cast YouTube as Public Enemy No. 1. YouTube, the industry has pointed out, is not only the most popular platform for free ad-supported music streaming, but during the first half of 2015 there was more music streamed on YouTube than on all other streaming services combined. Yet Spotify has been paying out more to rights holders than YouTube has been—not just per user, but in total as well.

industry has soured on ad-supported

streaming. And with superstars like Taylor Swift and U2 serving as the industry’s public face, labels and artists have launched a number of campaigns this year that cast YouTube as Public Enemy No. 1. YouTube, the industry has pointed out, is not only the most popular platform for free ad-supported music streaming, but during the first half of 2015 there was more music streamed on YouTube than on all other streaming services combined. Yet Spotify has been paying out more to rights holders than YouTube has been—not just per user, but in total as well.

No comments:

Post a Comment